Market Analysis Valuation Techniques And Risk Management: A Comprehensive Guide

5 out of 5

| Language | : | English |

| File size | : | 3922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 349 pages |

In the ever-evolving landscape of finance, market analysis, valuation techniques, and risk management are fundamental pillars for investors seeking to navigate the complexities of the market and make informed decisions. This comprehensive guide delves into these key concepts, providing a thorough understanding of their principles, applications, and interrelationships.

Market Analysis

Market analysis involves the study of market trends, patterns, and factors that influence the prices of financial instruments. It encompasses various approaches, including:

- Fundamental Analysis: Examines the underlying financial health and prospects of companies or economies, considering factors such as earnings, revenue, balance sheets, and industry trends.

- Technical Analysis: Analyzes historical price data and patterns to identify potential trading opportunities, focusing on chart patterns, indicators, and support and resistance levels.

- Quantitative Analysis: Utilizes statistical models and data analysis to predict market behavior and identify investment opportunities, often employing advanced mathematical techniques.

Valuation Techniques

Valuation techniques aim to determine the intrinsic value of financial instruments, considering various factors and methodologies. Common valuation methods include:

- Discounted Cash Flow (DCF): Calculates the present value of future cash flows expected from an investment, utilizing discount rates to account for time value of money.

- Multiples Approach: Compares the financial metrics of a target company to similar companies in the industry, using multiples such as price-to-earnings (P/E) or price-to-sales (P/S).

- Asset-Based Valuation: Focuses on the liquidation value of a company's assets, often employed for distressed companies or during bankruptcy proceedings.

- Comparable Transactions: Analyzes recent transactions involving similar assets or businesses to establish market value.

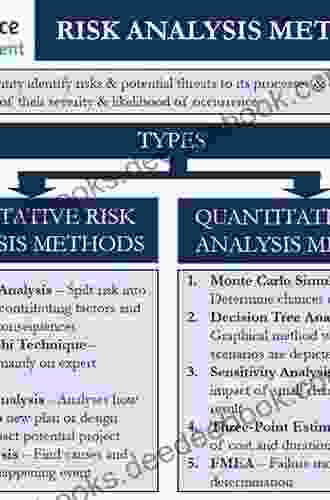

Risk Management

Risk management in finance involves identifying, assessing, and mitigating potential financial risks associated with investments. Key strategies include:

- Diversification: Spreading investments across different asset classes, industries, or geographic regions to reduce overall portfolio risk.

- Hedging: Using financial instruments such as futures, options, or credit default swaps to offset the risks of specific investments.

- Asset Allocation: Determining the appropriate mix of asset classes in a portfolio based on risk tolerance and investment objectives.

- Stress Testing: Simulating various market scenarios to assess the resilience and potential downside of an investment portfolio.

Interrelationships of Market Analysis, Valuation Techniques, and Risk Management

These three concepts are closely intertwined and interdependent. Market analysis provides insights into market dynamics and trends, informing valuation techniques used to determine fair value. Risk management incorporates both market analysis and valuation techniques to assess and mitigate potential risks associated with investment decisions.

For example, a company's fundamental analysis may indicate strong growth potential, leading to a higher valuation using DCF. However, risk management considerations may necessitate hedging strategies to mitigate potential market downturns or industry-specific risks. Conversely, technical analysis may identify a potential trading opportunity, but further analysis and valuation techniques should be employed before making a decision.

Market analysis, valuation techniques, and risk management are essential tools for investors seeking to make informed decisions and navigate the complexities of financial markets. By understanding the principles, applications, and interrelationships of these concepts, investors can enhance their investment strategies, mitigate risks, and achieve their financial goals. Continuous learning and adaptation to evolving market conditions are crucial for successful investment management.

5 out of 5

| Language | : | English |

| File size | : | 3922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 349 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Text

Text Story

Story Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Sentence

Sentence Foreword

Foreword Footnote

Footnote Scroll

Scroll Codex

Codex Tome

Tome Classics

Classics Narrative

Narrative Biography

Biography Autobiography

Autobiography Reference

Reference Dictionary

Dictionary Thesaurus

Thesaurus Resolution

Resolution Catalog

Catalog Card Catalog

Card Catalog Stacks

Stacks Periodicals

Periodicals Scholarly

Scholarly Lending

Lending Academic

Academic Special Collections

Special Collections Literacy

Literacy Study Group

Study Group Thesis

Thesis Dissertation

Dissertation Storytelling

Storytelling Awards

Awards Book Club

Book Club Theory

Theory Textbooks

Textbooks 1st Ed 2018 Edition Kindle Edition

1st Ed 2018 Edition Kindle Edition Kathy Santo

Kathy Santo Sarah Pinborough

Sarah Pinborough Michael Green

Michael Green Roxana Stan

Roxana Stan Shlomo Angel

Shlomo Angel Jann Mitchell

Jann Mitchell Kathleen Jamie

Kathleen Jamie Roberta Gregorio

Roberta Gregorio Joni Mayhan

Joni Mayhan 1 Aufl 2021 Edition

1 Aufl 2021 Edition Melvin Kaplan

Melvin Kaplan Chien Chi Lee

Chien Chi Lee Gerri Hirshey

Gerri Hirshey Norbert Mercado

Norbert Mercado Paula Nadelstern

Paula Nadelstern Richard Surman

Richard Surman Melinda S Mitchiner

Melinda S Mitchiner Janice E Mckenney

Janice E Mckenney Pj Thompkins

Pj Thompkins

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jesus MitchellBetween National and European Integration: Exploring the Dynamic Relationship...

Jesus MitchellBetween National and European Integration: Exploring the Dynamic Relationship...

Christian CarterNameless: The Memoirs of Jane Friendless Orphan - A Captivating Tale of...

Christian CarterNameless: The Memoirs of Jane Friendless Orphan - A Captivating Tale of... Mario BenedettiFollow ·13.3k

Mario BenedettiFollow ·13.3k Spencer PowellFollow ·13.8k

Spencer PowellFollow ·13.8k John UpdikeFollow ·9.1k

John UpdikeFollow ·9.1k Leo TolstoyFollow ·6.6k

Leo TolstoyFollow ·6.6k Terry PratchettFollow ·7k

Terry PratchettFollow ·7k Harry CookFollow ·9.4k

Harry CookFollow ·9.4k Allen ParkerFollow ·7.4k

Allen ParkerFollow ·7.4k Zadie SmithFollow ·11.2k

Zadie SmithFollow ·11.2k

Elton Hayes

Elton HayesUnveiling the Enchanting Legends of Emelina Grace and...

Emelina Grace: The...

Evan Simmons

Evan SimmonsWhat If Vietnam Never Happened: Foresight and Hindsight...

Published in 1955, Graham Greene's The Quiet...

Camden Mitchell

Camden MitchellThe Rise of Specialty Coffee, Craft Beer, Vegan Food,...

In recent years,...

Corey Hayes

Corey HayesModern Project Creative Techniques: A Comprehensive Guide...

In today's competitive business landscape,...

5 out of 5

| Language | : | English |

| File size | : | 3922 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 349 pages |