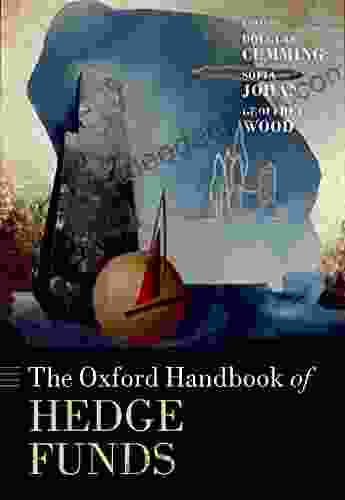

The Oxford Handbook of Hedge Funds: Unraveling the Complexities of a Multi-Trillion Dollar Industry

4 out of 5

| Language | : | English |

| File size | : | 12897 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 576 pages |

| Lending | : | Enabled |

The intricate world of hedge funds has long captivated the attention of investors, researchers, and policymakers alike. With their complex strategies, opaque operations, and potential for both exceptional returns and devastating losses, hedge funds have elicited a wide range of opinions and sparked numerous debates.

Published in 2017, The Oxford Handbook of Hedge Funds is a comprehensive and authoritative resource that delves into the multifaceted nature of this unique investment asset class. Edited by two leading scholars in the field, Tarun Ramadorai and Andrew Clare, the handbook brings together the insights of 40 renowned academics and industry practitioners, offering an unparalleled overview of the hedge fund industry.

Key Themes and Contributions

The Oxford Handbook of Hedge Funds is organized into four main parts, each exploring a distinct aspect of the industry:

Part I: Historical Evolution and Structural Characteristics

This section provides a historical account of the hedge fund industry, tracing its origins and evolution from the early days of leveraged investing to the complex and sophisticated strategies employed today. It also examines the structural characteristics of hedge funds, including their legal structures, fee models, and risk management practices.

Part II: Investment Strategies and Risk Management

The handbook delves deeply into the investment strategies and risk management techniques employed by hedge funds. It covers a wide range of approaches, from fundamental long-short equity investing to complex quantitative and algorithmic trading strategies. The contributors provide detailed explanations of these strategies, their historical performance, and the key risk factors associated with each.

Part III: Performance Analysis and Measurement

This section examines the challenges of hedge fund performance measurement and evaluation. It discusses the various metrics used to assess performance, the biases and limitations of these metrics, and the complexities of comparing hedge funds to other investment classes.

Part IV: Regulation, Taxation, and Transparency

The final section of the handbook explores the legal and regulatory frameworks that govern hedge funds. It covers topics such as the regulatory landscape in different jurisdictions, the impact of regulation on hedge fund operations, and the ongoing debate over hedge fund transparency and disclosure.

Strengths of the Handbook

The Oxford Handbook of Hedge Funds offers several key strengths that make it an invaluable resource for anyone seeking a comprehensive understanding of the industry:

- Comprehensive Coverage: The handbook covers a wide range of topics, from the history and evolution of hedge funds to the latest investment strategies and regulatory developments, providing a comprehensive overview of the industry.

- Expert Contributors: The handbook is written by a team of leading scholars and industry practitioners, ensuring that the content is authoritative and up-to-date.

- Rigorous Research: The contributors draw upon extensive research and empirical evidence to support their insights, providing a solid foundation for understanding the hedge fund industry.

- Clear and Accessible Writing: Despite the complexity of the subject matter, the handbook is written in a clear and accessible style, making it suitable for a wide audience.

- Current and Relevant: The handbook is continuously updated with new chapters and revisions, ensuring that the content remains relevant and up-to-date.

Applications and Impact

The Oxford Handbook of Hedge Funds has had a significant impact on the investment industry and academic research. It has become a standard reference for practitioners, investors, and regulators seeking to understand the hedge fund industry and its implications.

The handbook has also influenced academic research by providing a foundational framework for future studies. It has helped to identify key research questions, advance theoretical understanding, and enhance empirical methodologies in the field of hedge fund analysis.

The Oxford Handbook of Hedge Funds is an indispensable resource for anyone seeking a comprehensive and authoritative understanding of the hedge fund industry. Its comprehensive coverage, expert contributors, rigorous research, and clear writing make it a valuable tool for investors, researchers, and policymakers alike. Whether you are a seasoned hedge fund professional or a newcomer to the industry, The Oxford Handbook of Hedge Funds will provide invaluable insights and perspectives to help you navigate the complexities of this fascinating and dynamic asset class.

4 out of 5

| Language | : | English |

| File size | : | 12897 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 576 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Chapter

Chapter Text

Text Story

Story Reader

Reader Magazine

Magazine Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Synopsis

Synopsis Tome

Tome Bestseller

Bestseller Library card

Library card Autobiography

Autobiography Encyclopedia

Encyclopedia Dictionary

Dictionary Narrator

Narrator Character

Character Resolution

Resolution Librarian

Librarian Card Catalog

Card Catalog Archives

Archives Periodicals

Periodicals Study

Study Lending

Lending Reserve

Reserve Academic

Academic Journals

Journals Reading Room

Reading Room Rare Books

Rare Books Special Collections

Special Collections Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Storytelling

Storytelling Awards

Awards Reading List

Reading List Book Club

Book Club Theory

Theory Textbooks

Textbooks Robert Treskillard

Robert Treskillard Anja Carolina Christensen

Anja Carolina Christensen Marcia Mccormack

Marcia Mccormack Colleen Gleason

Colleen Gleason Joe Abercrombie

Joe Abercrombie Gerry Spence

Gerry Spence Theodora Goss

Theodora Goss Michael Avon Oeming

Michael Avon Oeming Allan Tidwell

Allan Tidwell Charles Long

Charles Long Natasha Tremblay

Natasha Tremblay Beatrix Potter

Beatrix Potter Brian Moses

Brian Moses Judy Blume

Judy Blume Robert Mann

Robert Mann Bori Kiss

Bori Kiss Daniel J Solove

Daniel J Solove Steve Bellinger

Steve Bellinger Paula Nadelstern

Paula Nadelstern Michelle Zimmerman

Michelle Zimmerman

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Peter CarterHistorical Atlas of Dermatology and Dermatologists: Unraveling the Tapestry...

Peter CarterHistorical Atlas of Dermatology and Dermatologists: Unraveling the Tapestry... Arthur C. ClarkeFollow ·14.6k

Arthur C. ClarkeFollow ·14.6k Craig BlairFollow ·6k

Craig BlairFollow ·6k Chad PriceFollow ·12.9k

Chad PriceFollow ·12.9k Fredrick CoxFollow ·14.6k

Fredrick CoxFollow ·14.6k Nathan ReedFollow ·8.4k

Nathan ReedFollow ·8.4k J.R.R. TolkienFollow ·14.8k

J.R.R. TolkienFollow ·14.8k Donald WardFollow ·10.8k

Donald WardFollow ·10.8k Andrew BellFollow ·10.2k

Andrew BellFollow ·10.2k

Elton Hayes

Elton HayesUnveiling the Enchanting Legends of Emelina Grace and...

Emelina Grace: The...

Evan Simmons

Evan SimmonsWhat If Vietnam Never Happened: Foresight and Hindsight...

Published in 1955, Graham Greene's The Quiet...

Camden Mitchell

Camden MitchellThe Rise of Specialty Coffee, Craft Beer, Vegan Food,...

In recent years,...

Corey Hayes

Corey HayesModern Project Creative Techniques: A Comprehensive Guide...

In today's competitive business landscape,...

4 out of 5

| Language | : | English |

| File size | : | 12897 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 576 pages |

| Lending | : | Enabled |